This proposal is expected to appear on Snapshot for voting on April 12, 2022 (UTC). Make sure to stake your vBNT for voting before this date and time to participate in the DAO decision.

Voting instructions

To support the proposed BNT liquidity mining budget, and the emissions rate, vote FOR

To oppose the proposed protocol upgrade, and the features detailed herein, vote AGAINST

Summary

- This proposal establishes an emissions program for BNT, which can be used to incentivise protocol participation for both BNT and non-BNT token holders, intended to grow the TVL of the platform, and further decentralize its liquidity provider user base.

- A budget of 40,000,000 BNT is proposed, with a BNT:TKN incentives quotient of 3:1, or 75% to BNT liquidity providers, and 25% to TKN liquidity providers. Therefore:

- The BNT auto-compounding rewards are proposed to utilize an exponential decay profile, with a half-life of 2 years (63,072,000 seconds). Therefore, under the proposed emissions scheme, the rate of rewards emission decreases predictably, achieving a halving every two years; the remaining rewards budget will be less than 1 BNT for the first time after approximately 18,133 days (49.7 years).

- The standard BNT rewards budget is proposed for the DAO to use at its discretion over the coming years. The 10,000,000 BNT budget includes:

- 134,400 BNT allocated for the open beta, as described in BIP 16.

- All BNT “dual-mining” (in-kind) incentives, up to a maximum 50,000 BNT per asset, previously approved by the BancorDAO [see the proposal, and its addendum].

- All future rewards programs and incentives for non-BNT assets, including those not yet decided, or proposed.

Understanding the BNT Rewards Distribution

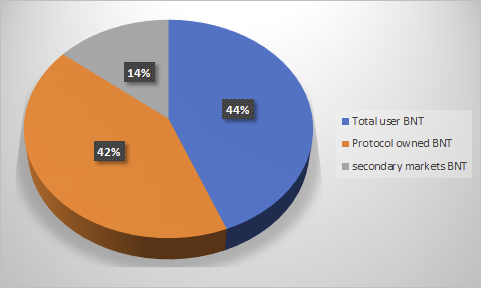

The BNT supply is at approximately 262.2 M tokens. Approximately 53% (139.7 M) belongs to the Bancor Protocol, 33% (85.3 M) belong to liquidity providers, and 14% (37.1 M) is spread across the secondary markets, user wallets and centralized exchanges. It is important to appreciate how these segments of the BNT supply interact with each other, and how liquidity mining (i.e. inflationary rewards distribution) can be managed without inflicting too much economic harm.

The liquidity mining programs of Bancor 3 are supported through a combination of auto-compunding, and standard rewards mechanisms. The former is the result of bnBNT pool token destruction by the protocol, resulting in an effective redistribution of the orange section of the chart above, directly to the blue section. Meaning, the auto-compounding rewards program functions by slowly relinquishing network-owned, staked BNT to the BNT liquidity providers (and de facto guardians of the protocol). Interestingly, this does not affect the BNT supply at all, until a user completes a withdrawal. Since a withdrawal from a BNT stake results in the minting of new BNT, and the return of bnBNT pool tokens to the protocol’s ownership, the result is a simultaneous increase in both the gray- and orange-colored slices of the chart, with a concomitant reduction in the blue slice (as a proportion of the total BNt supply). In essence - the staked nature of BNT results in a kind of self-correcting increase in liquidity as users withdraw from the protocol, which helps to temper volatility, and preserves the integrity of the protocol. However, this effect is finite; as the blue segment gains ground over the orange segment, the ability of the protocol to keep an even keel could be compromised.

It is impossible to know for certain where the line should be drawn, and a conservative view is warranted until new economic theory can be developed that is better suited to describing the rapid inflationary fiscal policies of DeFi projects, and their financial consequences. With that said, there is little cause for alarm. The Bancor Network Token is among the most liquid assets in its weight class, and the Bancor Protocol continues to control the lion’s share of the token supply, supporting natural price discovery and protection from market dysfunction, such as “rage quits” and other problematic behaviors.

To maintain the health of the token, and by extension the health of the system, the protocol- and user-owned BNT stakes ought to be comparable in size. Unfortunately it is impossible to know precisely how the BNT markets will develop over time. Price fluctuations, combined with changing BNT funding limits by the BancorDAO, can have a dramatic impact on the relative sizes of these segments. In lieu of a reliable predictor for these influences into the future, it is acceptable to model the token distribution in the present day and forecast future distributions based entirely on liquidity mining emissions. It is from this foundation that an approximate 30,000,000 BNT auto-compounding budget is proposed. At the conclusion of the program, and all else remaining equal, the protocol-owned, and user-owned segments are expected to be roughly equivalent.

The effect of standard rewards emissions should also be addressed. Unlike the auto-compounding rewards, there is no intrinsic stake that helps to maintain liquidity of the protocol. It is helpful to imagine the standard rewards (i.e. those given to non-BNT stakers) as being injected directly into secondary markets. The consequences of this remain to be seen; however, the trend is towards a diminishing liquid proportion of the token supply overall. While there are some nuances to how the equilibrium is re-established over the course of the emissions schedule (e.g. through the accumulation of BNT trade revenue, the effect of the Bancor Vortex, and staking sentiment amongst the community), the destabilizing effect is a foregone conclusion, and one that is likely to be received without too much controversy (I hope).

As before, it is impossible to describe strict guidelines for how these emissions should be managed on the non-BNT staking side of the user demographic, especially without knowledge of future shifts in the market. Therefore, similar to the case above, we can allow ourselves the assumption that the standard rewards emissions are essentially destined for the secondary market segment of the chart (gray-colored). Under this premise, it stands to reason that the total non-liquid component of the BNT supply should be similar to that which has sustained the protocol over the course of 2020. With this in mind, an acceptable non-liquid proportion of the token supply is somewhere in the range of 13-17%; targeting the upper bound allows for a 10,000,000 BNT budget for all incentives not associated with the auto-compounding rewards program. Importantly, the incentives used for the Beta release ought to be treated as though they were taken from this budget, as should all future rewards for any purpose other than rewarding BNT liquidity providers.

Program Duration

One of the most significant advantages of the Bancor 3 release is its ability to support reasonable, sustained rewards programs without pandering to the apparently insatiable inflation appetite of DeFi mercenaries. Similar to Bitcoin, the auto-compounding rewards programs on Bancor 3 can be made to follow an exponential decay curve, allowing for long-term distributions free from sudden shocks to both the token supply, and equally importantly, sudden cessation of rewards programs.

Here, it is proposed that the 30,000,000 BNT auto-compounding programutilize a 2-year half-life, creating a distribution schedule with the following profile:

To estimate the expected APR from liquidity mining emissions exclusively for BNT stakers, the following expression has been developed:

where a is the total emissions to be received by BNT stakers, b is the Unix Timestamp at the commencement of the staking rewards program, c is the decay constant, d is the total user-staked BNT on Bancor v2.1, e is Euler’s constant (2.71828…), f is the number of seconds in one day (86400), and g is the number of days in one year (365). If this proposal is successful, the total emissions (a) can be assumed to be 30,000,000 BNT. The commencement timestamp (b) is arbitrary; it can be set to any number, including zero. The decay constant (c) can be determined from the target half-life (t1/2), which is assumed to be two years (63,113,904 seconds), as follows:

The user-staked BNT can be calculated from the Bancor Dune Analytics page, and is assumed here to be 85,000,000 BNT. Therefore, the values a-g are constants.

The variable x represents the total days elapsed of the rewards program, and y represents the proportion of user-staked BNT in v3, compared to v2.1. These two values should be considered the inputs to a function that returns the apparent APR for the same day as x. This arrangement allows for the effect of different growth velocities of Bancor3 (with respect to BNT staking) to be examined with respect to the apparent APR (z, %):