Proposal to Whitelist Cartesi (CTSI) with 50,000 BNT Trading Liquidity Limit

For this proposal to pass, it requires a 35% quorum and 66.7% supermajority.

This proposal is expected to appear on Snapshot for voting on 2022-01-09T00:00:00Z. Make sure to stake your vBNT for voting before this date and time to participate in the DAO decision.

TL;DR

-

Proposal to whitelist CTSI.

-

Trading Liquidity Limit of 50,000 BNT.

-

There are no security concerns that could prohibit whitelist status.

-

There is no reason to doubt the legitimacy of the Cartesi Project. The project was founded in 2018 and the team is public.

-

The benefit to Bancor is clear. Providing CTSI liquidity will attract token LPs from Cartesi to swap on Bancor, and increase protocol trade volume.

Token Address: 0x491604c0fdf08347dd1fa4ee062a822a5dd06b5d

Project Website: Cartesi

Liquidity

The Deepest CTSI pools are:

The CTSI/ETH 1% Uniswap v3 pool with $827,681.09 liquidity [1].

The CTSI/USDT 0.3% Uniswap v3 pool with $291,747.60 liquidity [2].

A trading liquidity limit of 50,000 BNT opens up space for at least $346k liquidity in the pool, with BNT at $3.46. If the pool fills up, a trading liquidity limit increase will be proposed.

Token Security

CTSI does not have an elastic supply, or rebase mechanism. The CTSI token has a max supply cap of 1,000,000,000 CTSI. Contracts are standard ERC-20 OpenZeppelin contracts. The contracts don’t have any permissions that grant administrators unrestricted mint/burn capabilities.

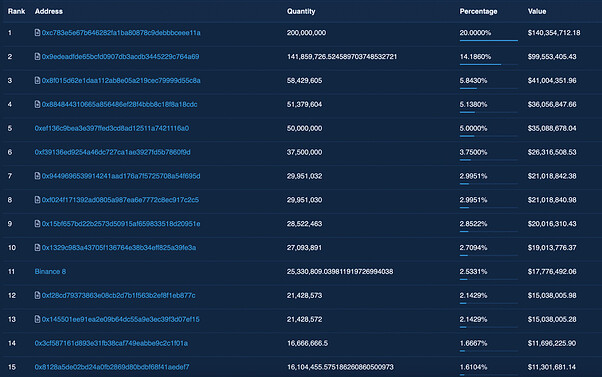

The top 15 contracts and addresses with the highest concentration of CTSI are Locking and Staking contracts, CTSI token timelock contracts, token distribution and team wallets, and Binance.

Figure 1 - Top 15 contract and address with the highest concentration of CTSI [3]

Project

Cartesi is the first OS on the blockchain, and their Layer-2 solution integrates Linux and standard programming environments to blockchain. This allows developers to code scalable smart contracts with rich software tools, libraries, and services they are used to.

Cartesi bridges the gap between mainstream software and blockchain, welcoming millions of new startups and their developers to blockchain by bringing Linux to blockchain applications. Cartesi combines a groundbreaking virtual machine, optimistic roll-ups, and side-chains to revolutionize the way developers create blockchain applications.

What gives Cartesi a competitive edge as a layer-2 and optimistic rollups solution is that it allows developers to code their smart contracts and DApps directly with mainstream software components and Linux OS resources. That represents more than an incremental improvement to decentralized applications. It is a necessary step toward the maturity of the whole blockchain ecosystem. Allowing mainstream programmability means that DApp developers have an entirely new expressive power to create from simple to rather complex smart contracts. It also means opening the doors for extensive adoption of regular developers who have never programmed for blockchain, as they will create decentralized applications with a coding experience similar to desktop or web.

Key Highlights

-

Cartesi is a layer-2 infrastructure for blockchains that allows developers to code highly scalable smart contracts with mainstream software stacks on a Linux VM. Cartesi uses a combination of rollups and side-chains.

-

Mainstream programmability: Developers create smart contracts with mainstream software stacks, taking a productive leap from the limited programmability of blockchain-specific VM’s to coding with software components supported by Linux.

-

Large scalability: Cartesi enables million-fold computational scalability, data availability of large files and low transaction costs. All while preserving the strong security guarantees of the underlying blockchain.

-

Privacy guarantees: Cartesi allows for decentralized games where players conceal their data and Enterprise applications that run on sensitive data, preserving privacy on DApps.

-

Portability: Cartesi is blockchain-agnostic and will run on top of the most important chains. The current implementations already support Ethereum, Binance Smart Chain, Matic (Polygon), with Elrond coming soon.

More information can be found on the official website, on the Whitepaper and on the CTSI Macroeconomy paper.

Tokenomics

CTSI is a utility token that works as a crypto-fuel for Noether.

-

Stakers receive CTSI rewards by staking their tokens and participating in the network.

-

Node runners are selected randomly according to a PoS system and gain the right to create the next block.

-

Users of the network pay CTSI fees to insert data on the side-chain.

CTSI also plays a role with Descartes Rollups.

-

CTSI will be used by DApps to outsource the execution of verifiable and enforceable computation to entities running Descartes nodes.

-

Full details can be read on the Cartesi Network and CTSI article.

Community and Communication

Cartesi is active on Telegram and Discord. The Cartesi team also operates an official Telegram Announcements, Twitter account, and Medium. The team’s official Github shows consistent activity with the latest commit on the 23rd December 2021, at the time of writing.

Available Audits

Cartesi contracts have been audited by Certik and SlowMist.

Market and Trading Data

-

CTSI’s price at the time of writing is $0.751541.

-

All-time high: $1.74 (9th May, 2021).

-

All-time low: $0.02670608 (8th May, 2020).

-

Price 90 days ago: $0.557986.

-

489,501,530.90 CTSI in circulation, with a maximum and total supply of 1,000,000,000 CTSI.

-

The current market capitalization is $367,366,887.

-

The CTSI token is available on, among others, Binance, Coinbase, Huobi, Gate.io, KuCoin, Kraken, Uniswap v3, PancakeSwap.

[3] Cartesi Token (CTSI) | ERC-20 | Address: 0x491604c0...a5dd06b5d | Etherscan